Sep 22, 2025

Boat Insurance for New Boaters: A Beginner's Coverage Checklist

Boat Insurance for New Boaters: A Beginner's Coverage Checklist

B

By Brad Simmons

Complete boat insurance guide for new boaters. Learn about liability, comprehensive coverage, named storms, and money-saving tips + checklist included

Insurance products

Blog Post

Education

TL;DR: Your Essential New Boater Insurance Roadmap

New to boating? Your insurance checklist starts with liability coverage (protects others) and comprehensive physical damage coverage (protects your boat). Most policies cost 1-5% of your boat's value annually, with comprehensive coverage running anywhere between $270-$900, depending on location. Add named storm coverage if you're in hurricane zones, consider agreed value over actual cash value for newer boats, and don't skip salvage and wreck removal coverage—it can save you thousands. Bundle with your RV or auto insurance for 10-25% discounts, and that boating safety course you've been meaning to take? It'll knock 5-15% off your premium. Ready to get covered so you can get back to the fun stuff?

How Does Boat Insurance Work for First-Time Owners?

Boat insurance works a lot like auto insurance, but with some water-specific twists that every new boater needs to understand. Think of it this way: your homeowner's policy might cover a small fishing boat with a 25-horsepower motor, but once you're looking at engines over 50-100 horsepower or heading "outside the inlet" to coastal waters, you definitely need dedicated marine coverage.

Here's what makes boat insurance different from your car or home policy. You're dealing with risks like salvage operations, wreck removal, fuel spills, and environmental damage—stuff that would never cross your mind when insuring your pickup truck. Plus, where you boat matters as much as what you boat, with coastal areas considered higher risk than inland lakes.

The good news? Marine insurance typically runs about 1.5% of your boat's total value annually. So that $20,000 pontoon boat you've been eyeing? You're looking at roughly $300 per year to protect it properly.

Feeling overwhelmed by all the options? Keep reading. We'll break down each coverage type step by step, then give you a simple checklist to take with you when you're ready to buy.

Most policies cover permanently attached equipment—think anchors, life jackets, trolling motors, and that fancy fish finder you installed. But here's where it gets interesting: you can add coverage for specialized gear, personal effects, and even tournament fees if you're getting into competitive fishing.

Get a personalized boat insurance quote from Roamly and see how much coverage you need for your specific vessel and boating style.

What's the Difference Between Liability and Full Coverage?

Liability-only coverage protects others when you're at fault, while full coverage also protects your own boat from damage, theft, and loss.

Let's break this down without the insurance jargon. Liability coverage is your safety net for when things go sideways and it's your fault. This covers damages and injuries to others, property damage, and legal fees if you're involved in an accident. Think of it as the bare minimum responsible boating requires.

But here's what liability-only doesn't cover: your own boat. Run aground on that sandbar you didn't see coming? Lightning fries your electronics during a sudden storm? Someone steals your outboard motor? You're on your own.

Full coverage adds what the insurance world calls "physical damage" protection. This includes:

- Collision coverage: Damage from hitting another boat, dock, or that underwater rock you swear wasn't there last season

- Comprehensive coverage: Protection against theft, vandalism, fire, storms, and acts of nature

- Agreed value vs. actual cash value: More on this crucial difference below

Even when boat insurance isn't legally required, we strongly recommend it for any vessel valued over $5,000 or with engines exceeding 50 horsepower. Why? According to the U.S. Coast Guard, there were over 6,200 reported boating accidents in 2022, resulting in 5,626 injuries. You don't want to be stuck with a six-figure lawsuit because someone got hurt wakeboarding behind your boat.

Do I Need Named Storm Coverage and Hurricane Protection?

If you boat in hurricane-prone areas, named storm coverage isn't optional—it's essential protection that can save you from catastrophic financial loss.

Named storms are weather systems with rotating circulation and wind speeds of 39 mph or more that receive official names from the National Weather Service. Here's the thing many new boaters don't realize: some boat insurance policies in hurricane zones actually exclude named storm damage by default.

That means Hurricane Helene damages your boat, but your policy doesn't cover "named storms"? You're paying for repairs out of pocket.

Nineteen states and the District of Columbia currently have some form of hurricane or named storm deductible in place, including Florida, Texas, Louisiana, North Carolina, and other coastal states where many of us love to boat.

Here's what named storm coverage typically includes:

- Hull and equipment damage from hurricane-force winds

- Flood damage from storm surges and heavy rainfall

- Haul-out reimbursement: Many insurers offer haul-out reimbursement coverage, typically covering 50% of professional haul-out costs up to $1,000 when your boat is in a named storm's projected path.

The catch? You can't buy named storm coverage at the last minute—once the National Weather Service issues a hurricane watch or warning, it's too late to add this protection.

Your insurer might also require a formal hurricane plan. This isn't just paperwork—it's your commitment to either haul your boat to approved storage or relocate it to safer waters when a storm threatens. Follow the plan, and you're covered. Ignore it, and you might be on your own.

What Are Salvage and Wreck Removal, and Why Do I Need Them?

Salvage covers the cost of rescuing your boat when it's in peril but repairable, while wreck removal pays to clean up what's left when your boat is a total loss.

Salvage applies when your vessel is in imminent danger—think serious grounding, fire, or taking on water—and needs professional rescue to prevent total loss. This isn't your buddy with a rope; we're talking about professional crews with pumps, airbags, compressors, divers, and specialized rigging equipment.

Salvage fees range from a simple price per foot multiplied by your boat's length to a percentage of the vessel's full insured value. For a 25-foot boat, you could be looking at thousands of dollars—and that's for a routine grounding.

Wreck removal is what happens when your boat can't be saved. Some insurance companies will cut you a check for the insured value plus 5-10% and walk away, leaving you to arrange and pay for wreck removal yourself. But here's the kicker: local authorities may require immediate removal to prevent environmental damage, leaving you stuck with an unexpected financial burden that can reach thousands of dollars.

The most comprehensive policies handle this differently. They'll cover wreck removal out of your liability coverage and pay up to your liability limit (usually $100,000 or more) to clean up properly.

Don't forget about fuel spill liability either. The most generous policies separate out fuel-spill liability and provide coverage up to $939,800, the maximum amount you can be held liable for under federal law. Trust us, you don't want to be personally responsible for cleaning up a fuel spill in environmentally sensitive waters.

How Do Agreed Value vs. Actual Cash Value Policies Work?

Agreed value pays you a predetermined amount if your boat is totaled, while actual cash value pays what your boat is worth today minus depreciation—often leaving you underwater financially.

Think of it this way: you buy a $40,000 boat and choose agreed value coverage. Three years later, it's stolen. Your insurance cuts you a check for $40,000 (minus deductible). Done.

Same scenario with actual cash value? Your insurer looks at comparable boats, factors in depreciation, wear and tear, and market conditions. They pay out the cash value at the time of loss, not what you paid or what it costs to replace. You might get $28,000 for that $40,000 boat.

Agreed value policies cost more than actual cash value policies, but here's why they're worth it for newer boats: you're guaranteed to recover your investment. No arguments about depreciation, no lengthy market assessments—just the amount you and your insurer agreed on when you bought the policy.

For older boats or if you're trying to keep premiums low, actual cash value might make sense. Just understand that you're taking on more financial risk if something happens.

The sweet spot? Many insurers offer a hybrid approach where they'll pay agreed value for the first few years, then switch to actual cash value as the boat ages. Ask about this option—it balances premium costs with protection.

What About Navigation Limits and Where Can I Take My Boat?

Navigation limits define where you're covered geographically, and violating them can void your coverage entirely—even for accidents that have nothing to do with location.

Insurance companies use navigation limits to manage risk, with coastal exposure considered high-risk and inland waters low-risk. The broader your cruising area, the higher your premium.

Some policies use very general language like "Inland and Coastal Regions of the United States," while others get specific with latitude and longitude coordinates. Some insurers define "hurricane boxes" during storm season—areas where your boat shouldn't be during certain months.

Here's what many new boaters don't realize: if your boat sinks while outside your agreed navigation area, your insurer may not pay for removal or related damage. Even if the sinking had nothing to do with your location.

The good news? You can usually add temporary extensions for special trips to places like the Bahamas or Mexico through separate riders. Planning a Florida Keys adventure, but your policy covers inland waters only? A temporary extension can give you peace of mind for a reasonable cost.

Accepting navigation limits—like restricting your cruising to inland waters rather than coastal regions—often results in meaningful discounts. If you're primarily a lake boater anyway, why pay for ocean coverage you'll never use?

How Can I Save Money on Boat Insurance as a New Boater?

New boaters can dramatically reduce insurance costs through safety education, smart policy choices, and bundling strategies that experienced boaters know but newcomers often miss.

Let's start with the easiest win: completing a certified boating safety course can save you 5-15% on your premium. Approved courses include BoatUS Foundation's Online Boating Safety Course, State Certified Safety courses, American Sailing Association courses, and U.S. Coast Guard Auxiliary programs. Many are available online and take just a few hours.

If you're already a Roamly customer for your RV, adding boat coverage could unlock additional savings that make the combined protection surprisingly affordable.

Here are more money-saving strategies experienced boaters swear by:

Seasonal layup discounts: If your boat hibernates during winter months, establishing a formal layup period can reduce premiums by 5-30% depending on length. This is especially valuable for northern boaters with short seasons.

Higher deductibles: Most boat policies have percentage-based deductibles (typically 1-2% of insured value), and choosing higher deductibles is one of the most straightforward ways to lower costs.

Engine type matters: Diesel engines often qualify for 5-10% discounts compared to gasoline motors because insurers consider them lower fire risk and more reliable.

Safety equipment discounts: Installing GPS tracking devices, automatic fire suppression systems, and anti-theft devices often triggers additional discounts.

Clean records pay off: A clean driving record translates to boat insurance discounts, and maintaining good credit can save hundreds annually.

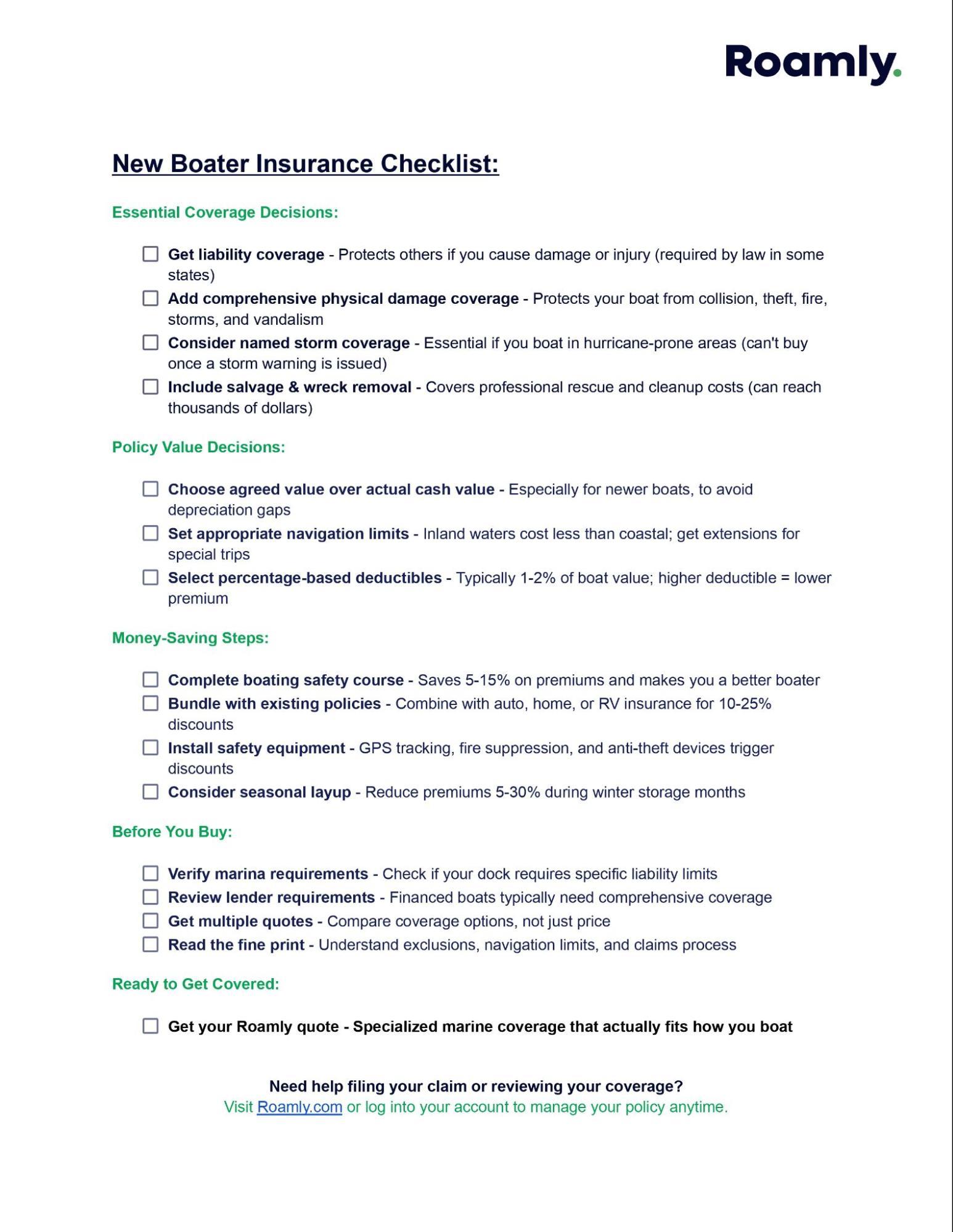

Your New Boater Insurance Checklist: Don't Hit the Water Without It

Alright, we've covered a lot of ground—from liability basics to named storm nuances. But let's be real: when you're standing at the marina ready to sign that insurance policy, you need a simple checklist to make sure you're not missing anything important.

Print this out, save it to your phone, or just keep it handy while you're shopping for coverage. Because the last thing you want is to realize you forgot something crucial when you're already 10 miles offshore.

Yes, many specialized marine insurers work with boaters who've been declined elsewhere. Factors like claims history, boat age, or high-risk activities might limit your options with standard carriers, but coverage is usually available—though potentially at higher rates.

Typical exclusions include wear and tear, gradual deterioration, marring, denting, scratching, animal damage, manufacturer's defects, design defects, and ice/freezing damage unless specifically added. Racing, commercial use, and intentional damage are also commonly excluded.

Based on industry data, average boat insurance ranges from $267 in Minnesota to $839 in Florida. A comprehensive policy typically costs 1-5% of the boat's insured value annually, though factors like location, boat type, and coverage limits significantly impact pricing.

Arkansas and Utah require boat insurance by law, and Hawaii mandates coverage for vessels 26 feet or longer. Even when not legally required, marinas often demand liability coverage for slip holders, and lenders require comprehensive coverage for financed boats.

Many homeowner's policies include coverage for smaller boats and motors, usually with horsepower limits of 25-100 HP, but coverage is typically limited to inland waters and may not include marine-specific risks like salvage or fuel spills. For larger boats or coastal boating, dedicated marine insurance is essential.

Roamly Insurance Group, LLC ("Roamly") is a licensed general agent for affiliated and non-affiliated insurance companies. Roamly is licensed as an agency in all states in which products are offered. Roamly license numbers. Availability and qualification for coverage, terms, rates, and discounts may vary by jurisdiction. We do not in any way imply that the materials on the site or products are available in jurisdictions in which we are not licensed to do business or that we are soliciting business in any such jurisdiction. Coverage under your insurance policy is subject to the terms and conditions of that policy and is ultimately the decision of the buyer.

Policies provided by Roamly are underwritten by Spinnaker Insurance Company, Progressive Insurance Company, Safeco Insurance Company, Foremost Insurance Company, National General Insurance, Mobilitas Insurance Company, and others.

Connect

© 2026 Roamly All rights reserved.